Drilling cost estimation with Monte Carlo simulation

Contact us

Drilling cost estimation and operational scheduling are uncertain. In most cases it is impossible to know the exact value until the drilling project is complete. One of the possible solutions to solving the challenge of modelling drilling time and cost is to apply a drilling software which uses Monte Carlo stochastic simulation approach.

Initial drilling cost estimation can involve a lot of guesswork, be full of biases and lead to unexpected expenses and delays. Well planning and drilling cost estimation is a complex multi-disciplinary task that involves a lot of stakeholders and is certainly not immune to the challenges of incorrect drilling budgeting.

In most cases, the drilling planning improvement method boils down to working in spreadsheets and communicating through emails and shared drives. However, given the inherent uncertainty of time and cost estimates, the alternative is to portray them with probability distributions of possible costs and schedule durations (or dates).

Monte Carlo statistical simulation for well planning

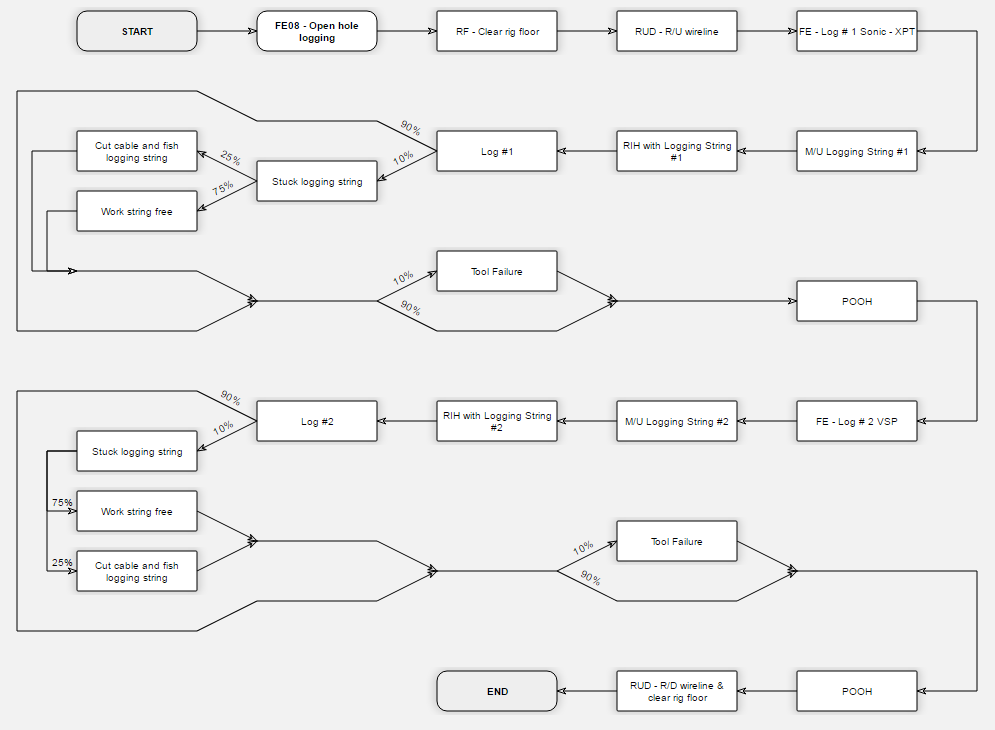

Through statistical simulation, Monte Carlo modeling method quantifies probabilistic cost and schedule distributions during well planning by the means of uncertainty analyses. Visual representation of the events, risks and the large number of probable drilling cost outcomes allow articulating challenges and collaboration across departments to align on key decisions.

Knowing the adverse outcomes of drilling time and cost, a stochastic approach allows the engineer to accurately set for AFE (authorisation for expenditure) targets and ensures that an adequate contingency budget is allocated if the well conditions change. The transparent and collaborative common workspace helps overcome individual bias and provides a quantitative, robust and fair assessment of every phase of drilling planning. The well documented, methodical approach allows the well engineering team to efficiently select the base case, understand risks and take the model from well planning phase into the detailed planning phase.

Field-proven drilling software delivers accuracy in drilling cost estimation

iQx is a field proven drilling software that delivers instant efficiencies in drilling cost estimation. It offers comprehensive drilling time models which form a solid framework for AFE. P1 time and cost modeling application applies Monte Carlo statistical simulation approach and allows to enter a range on all inputs. As a result, the Drilling & Wells teams are presented with the most optimum cost scenario and the accuracy of cost forecasting improves.

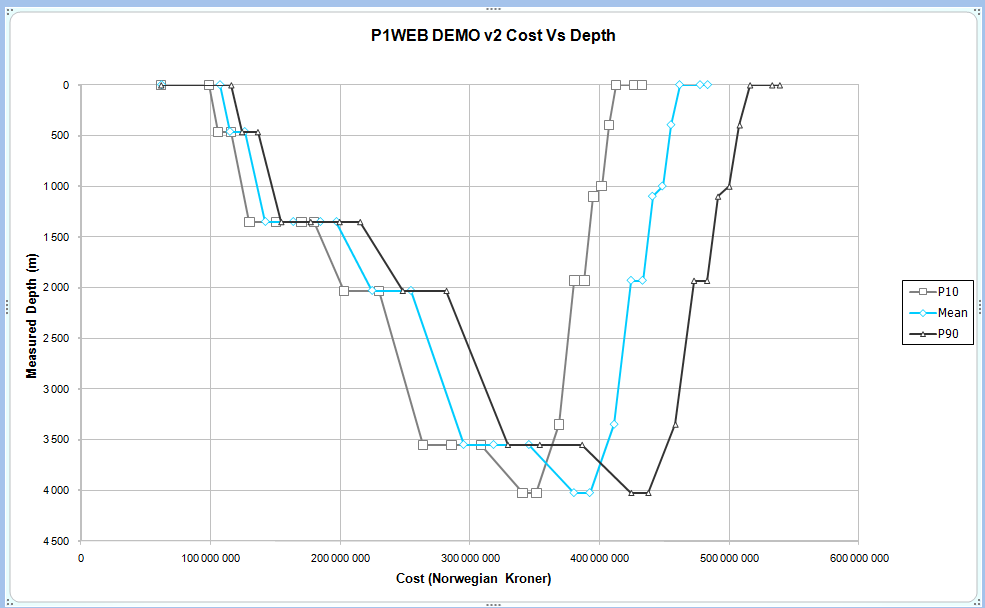

The outputs from P1™ for drilling time and cost planning can be used to estimate the probability of achieving the drilling goals within a certain time and budget. A 10% chance becomes P10, a 50% chance P50, or a 90% chance P90. Based on the degree of risk acceptable to stakeholders, P1™ provides data for well informed drilling investment decisions and helps to put in place optimum project management controls.

Was this article interesting? Contact us @ sales@agr-software.com for a demo.